25 Feb OPEN 2020: A New Decade – Panel Discussion

As 2020 is the start of a new decade we wanted to look forward and consider what will/may influence retail and real estate funds, in particular Greenman OPEN (OPEN), as we move towards 2030.

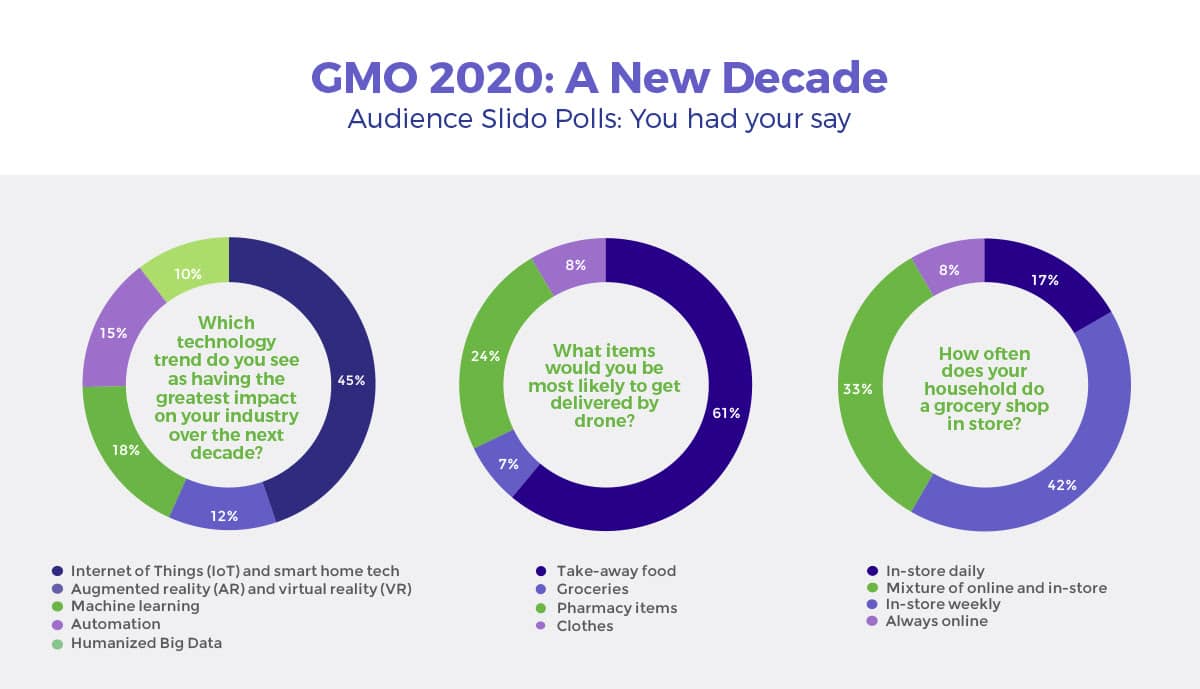

200 participants joined our panel of experts in an open and frank discussion on what technologies are impacting the retail and real estate markets.

We would like to extend a big thank you to our panellists, Christian Schimanski (Hamburg Commercial Bank), Dr Holger Wolf (White & Case LLP), Lynda Boylan (Manna.Aero) and Dr Angelus Bernreuther (Kaufland) and moderator Emily Bohill (Bohill Partners) for their interesting and engaging discussion.

INSIGHTS FROM THE DAY:

- The outlook for bricks and mortar German grocery stores looks stable with digitalisation focusing on addressing customer needs & overall retail experience.

- Drone deliveries could provide a low cost, high speed, environmentally friendly solution to last mile logistics, potentially working together with grocery stores in the future.

- Blockchain has the ability to revolutionise the way real estate sector operates from smart contracts to management and execution of property sales and leases.

- The continuation of a lower for longer interest rate environment will result in debt remaining cheaper for longer & yield gaps remaining significant.

- Greenman OPEN targets to achieve €1bn AUM by the end of 2020.