- Categories: Food Retail, Investment

Read the full interview in Living Retail Magazine where Johnnie, describes how food retailers have coped during the pandemic. Johnnie discusses Greenman’s strategy and how Greenman OPEN performed throughout the Covid-19 crisis, as well as looking to the future of food retail. Read the full article here.

- Categories: Innovation, Investment

The COVID-19 pandemic has accelerated key technology trends around the world, including remote working, which is in the top three trends according to We Forum. Over the last few months Greenman have focused on communicating across digital platforms to ensure we delivered a concise and transparent message. We released a regular Covid-19 update, we ramped

- Categories: Food Retail, German Market, Investment

Greenman, in its capacity as investment manager (the “AIFM”) to Greenman OPEN has prepared a document to update investors and potential investors on recent developments and occurrences linked to the COVID-19 pandemic which may impact either positively or negatively, OPEN, its tenants, properties and performance. As restrictions ease, these documents will now move from weekly to

- Categories: German Market

A total of €41.8bn was transacted in the German commercial real estate market in the first half of 2020. This figure increased by 21% compared to H1 2019 but was driven by the incredibly strong first quarter, before the dramatic upheavals of Covid-19 hit the market. Still, this very good volume highlights the confidence that

- Categories: Events, German Market, Investment

Meet Greenman at GRI Europe and France 2020, Paris 7-8 September In September senior real estate leaders will reconvene for the 22nd Annual Europe GRI in Paris. Much more than a conference, GRIs allow you to curate your own agenda over 2 days of collegial, informal conversations that aid price discovery and deal flow with

- Categories: Investment

At our OPEN 2020: A New Decade event on February 26th, we celebrated the crucial role our partnerships in the Irish Broker market have played in making the Greenman OPEN (OPEN) fund Germany’s largest food-retail investment fund. Since then the world has been coming to terms with COVID-19. Both Germany and OPEN are emerging strongly

- Categories: German Market, Investment

The total value of German Commercial Property transactions for Q2-2020 was €10-11bn, a decline of 19% compared to the same period in 2019 as COVID-19 caused major disruption to Europe’s largest market. However overall figures for H1-2020 reflect a 20% increase compared to H1-2019 thanks to an extremely strong 1st quarter. As Germany has

- Categories: Innovation, Investment

On the 8th of July Aviva rolled out current pricing for all clients with holdings in OPEN on their Self-Directed Investment Option (SDIO) Platform. This new feature brings Greenman’s Broker Portal and Aviva’s Investor Portal in line, ensuring cohesiveness and consistency in the provision of our mutual customer’s policy values. This development is a major

- Categories: Investment

Greenman are delighted to announce that as of next Monday 6th July, we will be reopening the doors to our Dublin office in line with Government guidelines. Dublin joins the Frankfurt and Berlin offices who opened their doors earlier in the month. There will be some small changes as Greenman have adapted their workplace

- Categories: Investment

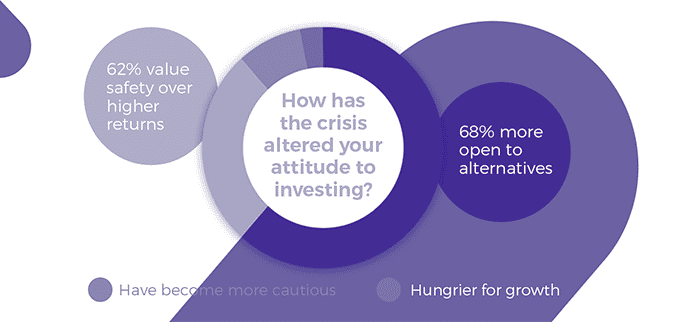

Tightening yields, geopolitical uncertainty, slowing economic growth….and now a global pandemic. The past few years have proved challenging for investors searching for income. The “lower for longer” interest rate environment has become “lower for even longer”. Yet investors must find somewhere to put their money. A recent survey conducted by Greenman highlighted a majority

- Categories: Investment, Press Releases

Greenman OPEN has entered into a €95.5 million framework agreement with Schoofs Immobilien, a leading German developer. Among the items agreed, the framework provides the fund the right to acquire three new food anchored retail assets in Germany. This is the first framework agreement of it’s type that Greenman OPEN has entered into and it

- Categories: Investment, Press Releases

Greenman OPEN, Germany’s largest food retail-focused investment fund, has arranged financing of €49.5 million for a portfolio of Kaufland-anchored real estate assets from Mittelbrandenburgische Sparkasse (“MBS”), Potsdam and Landesbank Baden Württemberg (“LBBW”), Leipzig. The two banks formed a consortium with MBS as the Mandated Lead Arranger. The credit facility is for 5 years.The 5 asset

- Categories: Investment, Press Releases

Greenman Fund Administration (“GMFA”), an affiliate of Greenman, the specialist real estate and investment fund manager, has acquired a 70% stake in Compagnie Financière et Boursière Luxembourgeoise SA (“COFIBOL”), a Luxembourg-based provider of fund administration and corporate services. GMFA completed the acquisition on 31st March 2020 following approval from the Commission de Surveillance du

- Categories: Food Retail, Investment

Johnnie Wilkinson, CEO of Greenman, speaks to Refi Europe regarding the impact of Covid-19 on food-retail property investment around Europe.

- Categories: Investment

During this time of uncertainty, Greenman’s priority is the health and safety of our staff, clients, business and our communities. We remain fully operational and we do not anticipate any material disruption of our services to you. However we are implementing our contingency plans for both our staff and our operations to ensure that