26 Mai Grocery retail performs consistently throughout periods of upheaval

Throughout the past few years, grocery retail has been the shining light of retail, performing consistently and steadily. Now, as the prevalence of the pandemic recedes in Europe, hospitality reopens, supply chains struggle and prices inflate, how will the grocery retail market perform?

Several consumer driven trends will affect grocery retailers‘ strategies. Amongst them are increased price sensitivity, higher focus on product sustainability and different channel offerings such as online. However, the essential nature of food will continue to underpin grocery retails’ performance – everyone needs to eat.

James Mc Evoy, Head of Acquisitions at Greenman, says: “Because of its essential nature, we see more and more investors adapting their strategies to include food retail anchored real estate. Grocers performed well over the last few years, and they tend to perform well throughout challenging economic periods.”

Greenman OPEN (“OPEN”) invests solely in grocery-anchored real estate located in Germany. Over 60% of the rental income from OPEN’s portfolio is generated by some of Germany’s leading grocery retailers. These highly creditworthy tenants are on long-term commercial leases that are linked to the Consumer Price Index (CPI).

Strong tenants and long CPI-linked leases provide stability during periods of uncertainty

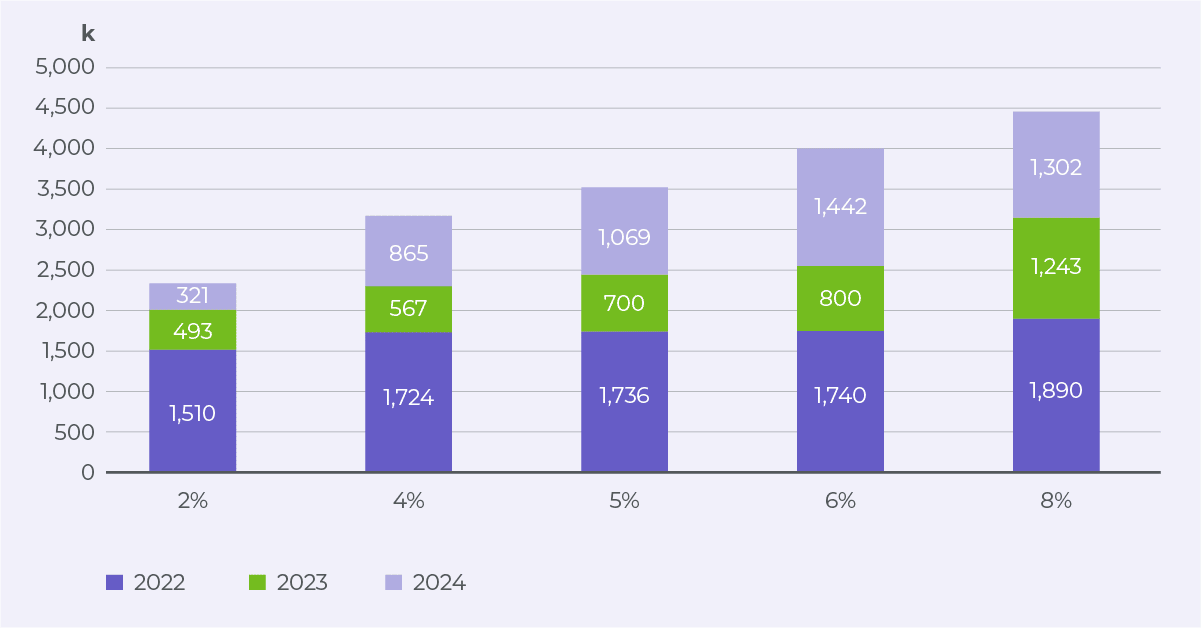

CPI-linked leases allow OPEN, as the landlord, to increase rents as inflation rises supporting property valuations and providing long-term income security. To date, OPEN has achieved €575k additional income from inflation-linked rent increases across its portfolio and forecasts a total growth in rent of c. €1.7m (a 3.4% increase) for 2022. This rental growth also positively impacts the portfolio value and provides stability during economic uncertainty.

The stability and strong performance of grocery retailers have also attracted digitally native retailers such as Amazon to recalibrate their strategy. Amazon’s initial foray into grocery retail started with the acquisition of Whole Foods, an American supermarket chain, and has been cemented with Amazon Go, a chain of checkout-less convenience stores open in the US and UK, underlining the company’s commitment to brick-and-mortar grocery retail and its value as a long-term investment.

To find out more about OPEN’s performance, click